FANUC, the world’s largest maker of industrial robots, plans to start connecting 400,000 of their installed systems by the end of this year. The goal is to collect data about their operations and, through the use of deep learning, improve performance. Similarly, Kuka is building a deep-learning AI network for their industrial robots.

FANUC, Cisco and General Motors

In 2014, FANUC partnered with Cisco on a 12-month zero downtime (ZDT) pilot project with General Motors. FANUC is now moving forward to connect all its manufacturing robots. The system proactively detects and informs of potential equipment or process problems before unexpected downtime occurs. This lets FANUC and its customers schedule and perform maintenance during a planned outage window, so operations aren’t disrupted. FANUC robots contain sensors that constantly gather data on temperature, cycles, machine operator activities, and other metrics. This data is then dynamically analyzed to predict wear on parts, such as bearings or transducers. An analytics engine captures out-of-range exceptions and predicts maintenance needs. The cloud app alerts FANUC service personnel and its manufacturing customer about the need for service and replacement part(s). The part(s) is automatically shipped to arrive at the factory in time for the next scheduled planned maintenance window.

This kind of proactive, planned maintenance can unleash dramatic savings and is different from present-day equipment- and part-life maintenance and service programs. General Motors estimated unplanned downtime costs thousands per minute and FANUC hopes to help GM save an estimated $40 million in downtime.

FANUC ZDT is part of the FANUC FIELD system which provides end users with an integrated manufacturing solution for interconnecting and analyzing data from CNC devices, robots and sensors. FANUC was named a 2016 Innovation Award winner for its ZDT Application.

“We partnered with Cisco to create highly secure connections from our robotic equipment in GM’s factories to Cisco’s Cloud Data Center where FANUC is able to perform analytics on how the robots are performing,” said Rick Schneider, Chairman and CEO, FANUC America. “The ability to collect data from our robots and analyze it in the cloud, to predict potential equipment issues before downtime occurs, allows us to proactively address our customer’s needs. With ZDT, we can also take advantage of the data collected from our robots to optimize GM’s manufacturing systems by reducing energy consumption, extending equipment life, improving cycle time and quality. Reducing downtime through ZDT has proven to have a direct and positive impact on GM’s plant’s performance.”

“We partnered with Cisco to create highly secure connections from our robotic equipment in GM’s factories to Cisco’s Cloud Data Center where FANUC is able to perform analytics on how the robots are performing,” said Rick Schneider, Chairman and CEO, FANUC America. “The ability to collect data from our robots and analyze it in the cloud, to predict potential equipment issues before downtime occurs, allows us to proactively address our customer’s needs. With ZDT, we can also take advantage of the data collected from our robots to optimize GM’s manufacturing systems by reducing energy consumption, extending equipment life, improving cycle time and quality. Reducing downtime through ZDT has proven to have a direct and positive impact on GM’s plant’s performance.”

Kuka and Huawei

Kuka is working with Huawei, the Chinese phone maker and communications service company, on a similar project to develop a global 5G network enabling the connection of Kuka robots across many factories. The companies say they plan to integrate artificial intelligence and deep learning into the system to help manufacturing businesses remain agile and drive growth. In a March 2016 agreement, Huawei and Kuka said they will collaborate in the areas of cloud computing, big data, mobile technology, and industrial robots.

[Gartner Research says Huawei has 8.3% of the global smartphone market, compared to 23% for Samsung and 15% for Apple. Huawei’s sales in the first couple of months of 2016 were up 59% from 2015 while Samsung’s smartphone sales were flat and Apple’s dipped 14%. Speaking at the Converge technology conference in Hong Kong, Richard Yu, the head of Huawei’s consumer electronics business, said he believes passing Samsung and Apple is a goal within reach.]

ABB and Microsoft

ABB offers an optional software package to ABB robot owners called Connected Services. This is a 24/7/365 monitoring service for their robots but administered by the client; it is not an ABB-wide effort to monitor and learn from their whole network of robots around the world. However, that learning capability is available and may be available in the future as can be seen by ABB’s Connected Service offered by ABB’s power business, where they are working together with Microsoft on a cloud-based e-mobility charging platform for power stations for electronic vehicle recharging. This will include user recognition, accepting payments, and data transfer of streaming data for system stability and monitoring.

“ABB and Microsoft Corp. announced [in March, 2016] the worldwide availability of a new electric vehicle (EV) fast-charging services platform. The collaboration will also take advantage of machine learning and predictive analytic capabilities to drive future innovations. Under the new collaboration, all ABB chargers will be connected to the Microsoft Azure cloud and surrounded by value-adding services, allowing operators and manufacturers and partners to take advantage of a world-class platform.”

Black Box Deep Learning

Kuka, ABB and FANUC – as are most robot makers – are late to the AI and deep learning party, but still very welcomed.

Aethon, a mobile robotics company focusing on the hospital industry, started their Cloud Command Center in 2013 from which they remotely monitor, support and even control the autonomous mobile robots installed at their customer’s locations. Aethon staffs the command center 24/7/365 and has over 400 TUGs in 140 locations online and in constant communication with the command center. Occasionally a TUG finds itself in a situation where it needs help. Rather than rely on customer personnel to address this, the command center takes over and manages the situation.

Algorithms monitor the status of each TUG in real-time and if the algorithms detect a TUG might need help an alert is sent to an on-duty support staff member who, using a secure VPN connection, can connect to the TUG’s on board sensors to assess the situation. In the simplest of solutions, the operator can drive the device out of the situation. Whatever the case, the command system updates with the solution and the criteria that precipitated the situation. Thus, the system is not only handling problems, it is learning how to anticipate those very same situations in the future and proactively prevent them.

The most visible of the efforts in deep learning are in Silicon Valley which has seen widespread start-ups in AI research by almost every car company, Baidu, Alibaba and, most recently, Toyota’s $1 billion investment in establishing the SV Toyota Research Institute headed by Gil Pratt (of DARPA’s Robotics Challenge fame).

Apple, Google and Facebook have led investments in more advanced uses, but practical deep learning systems such as Aethon’s, FANUC’s and Kuka’s are also becoming prevalent in the industrial sector.

The black box concept, i.e., the storing of streamed sensor data for analysis and learning, is a valuable tool in air safety and may soon become a mainstay in autonomously driven transportation, mobile robots and robotics in general. That data, and super-fast computer processing, are enabling deep learning engines to find and build patterns that can make the devices safer, more productive, and more cost-effective.

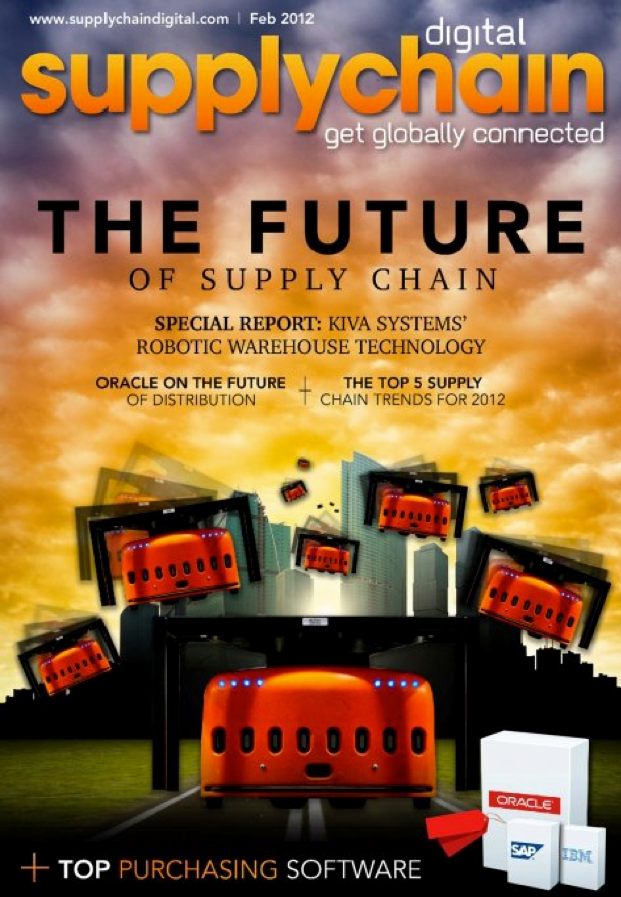

Intelligrated has been a successful integrator of mobile and stationary robotic solutions and systems for 20+ years for manufacturing, warehousing and distribution material handling and automated storage and retrieval. With $900M in annual sales, 3,100 employees in facilities in the U.S., Canada, Mexico, Brazil and China. In recent years the company has posted double-digit year-over-year growth. Intelligrated brings a large IP portfolio of warehouse automation, order fulfillment and software solutions and has an extensive presence in North American e-commerce and the retail, and food and beverage markets.

Intelligrated has been a successful integrator of mobile and stationary robotic solutions and systems for 20+ years for manufacturing, warehousing and distribution material handling and automated storage and retrieval. With $900M in annual sales, 3,100 employees in facilities in the U.S., Canada, Mexico, Brazil and China. In recent years the company has posted double-digit year-over-year growth. Intelligrated brings a large IP portfolio of warehouse automation, order fulfillment and software solutions and has an extensive presence in North American e-commerce and the retail, and food and beverage markets. The material-handling division of forklift maker Linde AG, including the STILL brand of trucks and lifts, was spun off to create the KION Group in August 2006 and was sold to investment funds KKR and Goldman Sachs in December 2006. The KION Group acquired Baoli, a Chinese lift manufacturer, in 2009. In 2012, Weichai Power (whose massive circular office complex pre-dates Apple's) acquired a 25% stake in KION Group and a 70% stake in Linde. It was, at the time, the largest direct investment by a Chinese company in a German company. In 2013, Weichai, through its subsidiary Shandong Heavy Industry Group, increased its holdings to 30%, and later purchased a 3.3% share from Superlift, the then top shareholder of KION. Weichai subsequently became the new top shareholder with an ownership of 33.3% and the right of control. Recently, the German press reported that Weichai again increased its holdings by another 5%, to a 38.25% stake, which helped Weichai cement control of the group. Weichai Power Co., Ltd is a Chinese state-owned enterprise in Shandong province specialised in the research and development, manufacturing and sale of diesel engines. Its products are used in vehicles, marine vessels and power generators.

The material-handling division of forklift maker Linde AG, including the STILL brand of trucks and lifts, was spun off to create the KION Group in August 2006 and was sold to investment funds KKR and Goldman Sachs in December 2006. The KION Group acquired Baoli, a Chinese lift manufacturer, in 2009. In 2012, Weichai Power (whose massive circular office complex pre-dates Apple's) acquired a 25% stake in KION Group and a 70% stake in Linde. It was, at the time, the largest direct investment by a Chinese company in a German company. In 2013, Weichai, through its subsidiary Shandong Heavy Industry Group, increased its holdings to 30%, and later purchased a 3.3% share from Superlift, the then top shareholder of KION. Weichai subsequently became the new top shareholder with an ownership of 33.3% and the right of control. Recently, the German press reported that Weichai again increased its holdings by another 5%, to a 38.25% stake, which helped Weichai cement control of the group. Weichai Power Co., Ltd is a Chinese state-owned enterprise in Shandong province specialised in the research and development, manufacturing and sale of diesel engines. Its products are used in vehicles, marine vessels and power generators. Dematic is a manufacturer of AGVs, palletizers, storage and picking equipment including automated storage and retrieval systems, sorters and conveyors, an integrated software platform, and other automation technologies. Revenues were $1.8 billion for 2015 and have grown at a 12% CAGR since 2013. Dematic employs ~6,000 including over 3,000 engineers in software development, R&D, engineering, project management and customer service.

Dematic is a manufacturer of AGVs, palletizers, storage and picking equipment including automated storage and retrieval systems, sorters and conveyors, an integrated software platform, and other automation technologies. Revenues were $1.8 billion for 2015 and have grown at a 12% CAGR since 2013. Dematic employs ~6,000 including over 3,000 engineers in software development, R&D, engineering, project management and customer service.

Endeavor Robotics

Endeavor Robotics Throughout 2015, for a year and a half, Harvest Automation split their energies between their business in agricultural field robots that transported and positioned potted plants, and a new, flexible material handling robot, in a new and separate work division. The new robot would work in factories, warehouses and distribution centers. The results of this new division's efforts were uncertain, optimistic, and costly. During those 18 months the ag business went dormant and key people left. Joe Jones, one of the founders and CTO, left to lead a startup developing a robotic weeding device for home gardens. Others joined Harvest to help transition the single-purpose field robot with a limited skill set into a multi-purpose, self-navigating, material handling robot in an even bigger warehousing pick-and-transport system. MaryEllen Sparrow came with a background in warehousing and distribution center software to head up the software development team.

Throughout 2015, for a year and a half, Harvest Automation split their energies between their business in agricultural field robots that transported and positioned potted plants, and a new, flexible material handling robot, in a new and separate work division. The new robot would work in factories, warehouses and distribution centers. The results of this new division's efforts were uncertain, optimistic, and costly. During those 18 months the ag business went dormant and key people left. Joe Jones, one of the founders and CTO, left to lead a startup developing a robotic weeding device for home gardens. Others joined Harvest to help transition the single-purpose field robot with a limited skill set into a multi-purpose, self-navigating, material handling robot in an even bigger warehousing pick-and-transport system. MaryEllen Sparrow came with a background in warehousing and distribution center software to head up the software development team.