April has seen Chinese VCs acquiring robotic ventures, buying out competitors, seeking funding to scale up production, and shoring up industry gaps.

Look at these four transactions:

- Beijing-based Ninebot, a Segway competitor, acquired Segway;

- Chinese venture fund Cybernaut plans to invest $200 million into Russia’s Skolkovo Center to incubate Russian inventions manufactured and marketed in China;

- China South Rail paid $190 million to acquire SMD, a UK deep-sea robot manufacturer;

- and Chinese drone maker DJI is forecasting global 2015 sales of $1 billion and a market value of $10 billion as it seeks funds to scale up it’s operations.

Ninebot acquires Segway

Ninebot, a Beijing-based 2012 startup, markets their device as a personal transportation robot. Segway has sued and accused Ninebot of patent infringement but all that is now water under the bridge because Ninebot acquired (for an undisclosed amount) all the intellectual property as well as the company and facilities of Segway. Although the two companies will retain their brand identities and separate locations, the transaction was an acquisition nonetheless and all Segway’s IP are now owned by Ninebot.

Ninebot, a Beijing-based 2012 startup, markets their device as a personal transportation robot. Segway has sued and accused Ninebot of patent infringement but all that is now water under the bridge because Ninebot acquired (for an undisclosed amount) all the intellectual property as well as the company and facilities of Segway. Although the two companies will retain their brand identities and separate locations, the transaction was an acquisition nonetheless and all Segway’s IP are now owned by Ninebot.

Bedford, NH-based Segway’s press release calls the transaction a “Strategic Combination”; Ninebot’s website calls it an acquisition. Included in Ninebot’s announcement of the acquisition was notice that Ninebot had raised $80 million from Xiaomi, Shunwei and Sequoia VCs.

Segway was launched in 2001 by Dean Kamen’s group. It struggeled to live up to all the ballyhoo from its launch when it was called the “future of transportation.” In 2009 Segway was purchased by British entrepreneur Jimi Heselden who was killed in 2010 while riding a Segway off a cliff. It was then bought by Saint Louis, MO-based Summit Strategic Investments in 2013 and it was that firm that did the deal with Ninebot. Certainly the real prize is Segway’s 400+ patents related to personal transportation devices being transferred over to Ninebot.

According to TechCrunch, “Ninebot plans to use the purchase to expand its product line. Founder and CEO Gao Lufeng said ‘After establishing the alliance, the company will apply a series of technologies into its future products, covering electric driving, mobile internet, and man-machine interaction. This combination creates great opportunities for the development of the short-distance transportation industry.'”

Commenting on the transaction, Robots Dreams blogger Lem Fugitt said, “While Segway management is positioning the take-over as positively as they can, in the long term it appears to be a major loss for U.S. technology, intellectual property, and manufacturing. The most telling comment from Segway’s president Rod Keller, as reported in the New Hampshire Union Leader newspaper, was, ‘If you can’t beat ‘em, join ‘em.’”

Cybernaut to invest $200 million into Skolkovo robotics startups

The Skolkovo Foundation outside Moscow, a large campus being constructed to focus on transferring Russian science into tangible products and to incubate Russian startups to make that happen, has signed a strategic partnership with Cybernaut Investment Group for Cybernaut to invest $200 million with Skolkovo in IT, space, telecommunication and robotic products that can be manufactured and marketed in China.

The Skolkovo Foundation outside Moscow, a large campus being constructed to focus on transferring Russian science into tangible products and to incubate Russian startups to make that happen, has signed a strategic partnership with Cybernaut Investment Group for Cybernaut to invest $200 million with Skolkovo in IT, space, telecommunication and robotic products that can be manufactured and marketed in China.

Hangzhou-based investment firm Cybernaut Investment Group will also create a new Chinese robotics center in Hangzhou to supplement Skolkovo’s efforts. Cybernaut is one of China’s largest VCs.

An in-depth review of the Skolkovo Cybernaut deal can be found at here.

China South Rail acquires SMD for $190 million

SMD, a UK based provider of underwater ROVs and ROV systems, tractors and trenchers for laying cable, sub-sea mining and oil and gas operations, was sold to Zhuzhou CSR Times Electric, a subsidiary of China South Rail (CSR), a state-owned conglomerate, for $190 million.

According to the Want China Times, the acquisition is expected to help China obtain core deep-sea robotic technology and equipment, andl will also help CSR absorb the mature industry platform and global sales network of SMD, supporting it to enter the global deep-sea market. This will complement CSR’s existing businesses in offshore wind energy, shipyard, marine engineering and drilling and help the Chinese company build an industrial chain for marine equipment.

A recent article in The Economist analyzed and charted the number of Chinese mergers and acquisition transactions in the EU.

Chinese deals in Europe as a whole rose from $2 billion in 2010 to $18 billion in 2014. Europe is attractive because it has lots of businesses going cheap — privatizations, cash-strapped firms and a weak euro. Chinese firms are following an edict to acquire advanced technology and high-quality brands from abroad that the government laid down in its five-year plan of 2011. Until recently most outbound dealmaking was by state firms buying up raw materials. Now high value-added businesses are the main target, and private capital is flowing.

SZ DJI Innovations seeks scale-up funding

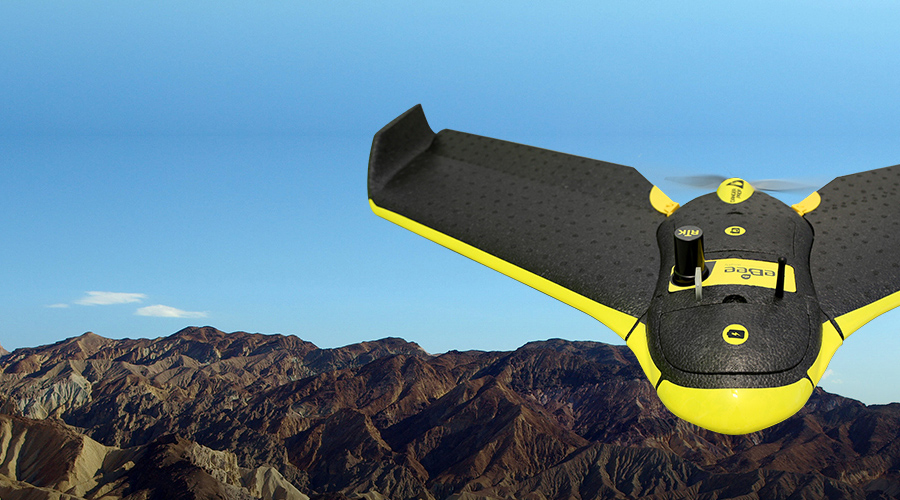

SZ DJI Innovations expects their revenue to exceed $1 billion this year. That information is part of the material being shown to raise funds for the company. The Wall Street Journal reported that DJI has set a valuation as high as $10 billion and that several Silicon Valley VC firms have offered to invest. The Shenzhen company has sold hundreds of thousands of their drones to hobbyists, journalists, photographers, real estate agents and other business people worldwide. According to the WSJ, DJI has taken minimal outside capital and instead has used cash flow to fund its rapid expansion which recently was reported to include three factories and 2,800 employees.

SZ DJI Innovations expects their revenue to exceed $1 billion this year. That information is part of the material being shown to raise funds for the company. The Wall Street Journal reported that DJI has set a valuation as high as $10 billion and that several Silicon Valley VC firms have offered to invest. The Shenzhen company has sold hundreds of thousands of their drones to hobbyists, journalists, photographers, real estate agents and other business people worldwide. According to the WSJ, DJI has taken minimal outside capital and instead has used cash flow to fund its rapid expansion which recently was reported to include three factories and 2,800 employees.

One quote by Chris Dixon of VC Andreessen Horowitz is particularly interesting:

Companies like DJI right now have good momentum, but they’re hardware makers Next year or the year after that, you’re going to see hundreds of DJI clones. I don’t think long term that’s a good bet. Software is going to eat drones.

I disagree. I see a parallel to the robotics industry of today where a few big firms make the basic industrial robot arms but thousands of independent global consultants, distributors, integrators and engineers add value through software and add-on devices just as mapping, data mining, sensor manufacturers and aerial service providers are beginning to do today for the drone industry.

If you liked this article, you may also be interested in:

- Video describes accelerating robot deployment in China

- Sino-Russian robotics boosted as Skolkovo signs $200M deal with Chinese investment fund

- Cars in the UK, China, LA, CES and here : Robocar news update

- Foxconn begins selling noodle-making robot

- 40% annual growth forecast for Chinese robotics

See all the latest robotics news on Robohub, or sign up for our weekly newsletter.

Ecoppia

Ecoppia A Hong Kong-based start-up,

A Hong Kong-based start-up,

Airware received an undisclosed investment from Intel Capital, which now joins GE Ventures, Andreessen Horowitz, Google Ventures, Kleiner Perkins and a host of other prominent VCs in funding this autopilot startup. The startup received $40.5 million prior to the Intel investment.

Airware received an undisclosed investment from Intel Capital, which now joins GE Ventures, Andreessen Horowitz, Google Ventures, Kleiner Perkins and a host of other prominent VCs in funding this autopilot startup. The startup received $40.5 million prior to the Intel investment.

“Robots are going to change the economic calculus for manufacturing,” says Hal Sirkin, a Chicago-based senior partner of Boston Consulting Group. “People will spend less time chasing low-cost labor.”

“Robots are going to change the economic calculus for manufacturing,” says Hal Sirkin, a Chicago-based senior partner of Boston Consulting Group. “People will spend less time chasing low-cost labor.”

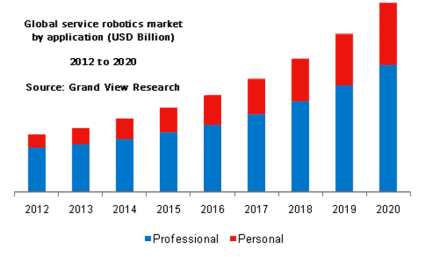

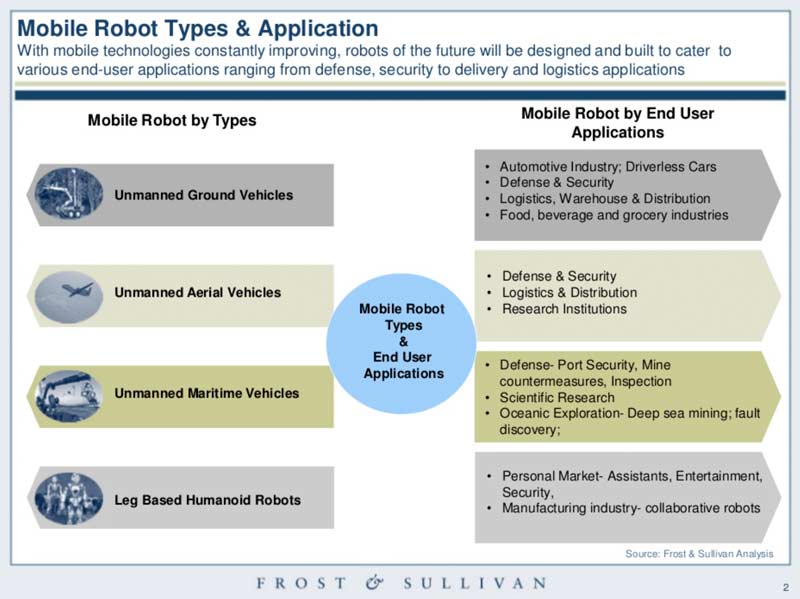

There is broad recognition within the business world of the value of robotics and that growing awareness is spreading to the media and financial community. Efficiency, reliability, low spoilage, and higher overall productivity are the real products of advanced automation. And the newer air, land and sea service robots are providing the wow factor. In the last 12 months there have been special sections about robotics in The Economist, The Financial Times, The Wall Street Journal, Time Magazine and many others. And many financial institutions and consulting firms such as McKinsey and Deloitte have produced special reports about the march of advanced manufacturing and its effect on jobs, job types, job creation and employment in general.

There is broad recognition within the business world of the value of robotics and that growing awareness is spreading to the media and financial community. Efficiency, reliability, low spoilage, and higher overall productivity are the real products of advanced automation. And the newer air, land and sea service robots are providing the wow factor. In the last 12 months there have been special sections about robotics in The Economist, The Financial Times, The Wall Street Journal, Time Magazine and many others. And many financial institutions and consulting firms such as McKinsey and Deloitte have produced special reports about the march of advanced manufacturing and its effect on jobs, job types, job creation and employment in general. Global industrial robot sales reached 225,000 units in 2014, 27% more than 2013. About 56,000 were sold in China, a growth of 58% over 2013. Chinese companies made 16,000 of the 56,000 robots sold domestically. To increase the number of domestically made robots, many local governments have provided investment credits and other attractive financial reasons to build in their areas, and the number of vendors has grown from fewer than 100 (of which even fewer were manufacturers; most were integrators and distributors) to almost 500. By the end of 2014, there were about 500+ companies in the sector, with 90% focusing on component manufacturing and integration. China Daily expects the number to increase to 800 by the end of this year, but also that there will be more than 10% manufacturers. Thus China is cultivating their own in-country robotics industry. They’ve set up a robotics association, the

Global industrial robot sales reached 225,000 units in 2014, 27% more than 2013. About 56,000 were sold in China, a growth of 58% over 2013. Chinese companies made 16,000 of the 56,000 robots sold domestically. To increase the number of domestically made robots, many local governments have provided investment credits and other attractive financial reasons to build in their areas, and the number of vendors has grown from fewer than 100 (of which even fewer were manufacturers; most were integrators and distributors) to almost 500. By the end of 2014, there were about 500+ companies in the sector, with 90% focusing on component manufacturing and integration. China Daily expects the number to increase to 800 by the end of this year, but also that there will be more than 10% manufacturers. Thus China is cultivating their own in-country robotics industry. They’ve set up a robotics association, the  Vision-enhanced robotic systems are becomming the top reason for upgrading and deploying vision-enabled robots and a core reason for the steady upward growth of the robotics industry. Amazon just brought the issue to the public and media’s attention with their recent

Vision-enhanced robotic systems are becomming the top reason for upgrading and deploying vision-enabled robots and a core reason for the steady upward growth of the robotics industry. Amazon just brought the issue to the public and media’s attention with their recent  A public-private movement to figure out ways to keep labor from being offshored to lower labor cost countries started first in Europe and then followed in the US. It was focused on the small and medium-sized enterprises – factories and shops of less than 500 employees – and was called the SME movement. The concept was that if you empowered shop employees with robotic tools that improved their combined productivity, the SME would become more cost efficient and competitive and therefore not have to move offshore.

A public-private movement to figure out ways to keep labor from being offshored to lower labor cost countries started first in Europe and then followed in the US. It was focused on the small and medium-sized enterprises – factories and shops of less than 500 employees – and was called the SME movement. The concept was that if you empowered shop employees with robotic tools that improved their combined productivity, the SME would become more cost efficient and competitive and therefore not have to move offshore.

The Fetch Robotics system is composed of a mobile base (called Freight) and an advanced mobile manipulator (called Fetch). Fetch and Freight can autonomously find and use a charging dock for continuous operations. In addition, the system includes accompanying software to support the robots and integrate with the warehouse environment. Both robots are built upon the open source robot operating system, ROS.

The Fetch Robotics system is composed of a mobile base (called Freight) and an advanced mobile manipulator (called Fetch). Fetch and Freight can autonomously find and use a charging dock for continuous operations. In addition, the system includes accompanying software to support the robots and integrate with the warehouse environment. Both robots are built upon the open source robot operating system, ROS.

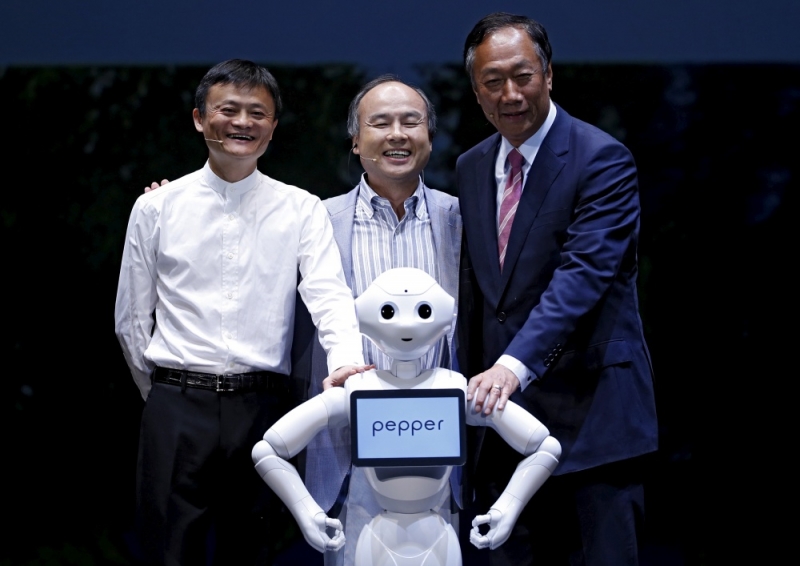

Peppers are showing up in all sorts of places. This photo, from Xinhua, which appeared in the

Peppers are showing up in all sorts of places. This photo, from Xinhua, which appeared in the

Developing Story: Softbank today

Developing Story: Softbank today